Quickest Way To Increase Your Revenue Is To Stop Revenue Leakage

- March 24, 2024

- Posted by: FOYI

- Category: Blog

Revenue leakage can have a significant impact on a company’s financial health and overall performance, often going unnoticed until it’s too late. But while revenue leakage can be very difficult to detect, for fleet operators, implementing effective strategies to minimise its effects is crucial.

This blog explores the hidden causes of revenue loss in fleet operations and offers a strategic approach to sealing these costly gaps.

Where revenue margins are tight, effective pricing strategies for maximising profitability are vital. For fleet operators, there are many ways to do this: negotiating better contracts, improved use of technology, increased focus on customer retention, and beyond.

But even the best-laid business plans can be undermined by unaddressed revenue leakage.

Revenue leakage refers to the loss of revenue due to various inefficiencies, errors, or issues within a company’s processes and systems. It can occur at different stages of the revenue cycle, and most often arises from discrepancies between intended pricing policies and their actual implementation at the branch level.

Understanding how revenue leakage occurs—and implementing robust measures to identify and prevent it—can make a significant difference in your bottom line.

Understanding Revenue Leakage: Expectation vs. Reality

The pricing of your product or service is usually determined by someone from the head office. This pricing data generally includes information about the retail price and discounting methods based on a combination of customer profile, purchase quantity, time of the year, or other factors—with the exact details unique to your business.

This pricing matrix is shared with multiple branches in your organisation, either as a printed document or through a software application that your front desk staff uses at the point of purchase.

But while many organisations have this kind of standardised approach to quoting and invoicing, the reality often involves considerably more nuance and flexibility than described above.

This variation from official pricing guidelines set by head office is at the heart of revenue leakage.

Expectation: The Ideal Process

As a baseline, let’s take a look at a typical ‘by the book’ transaction—what most business owners assume is happening when a customer requests a quote and a branch fulfils an order.

1. The Customer Makes a Request

A customer contacts your branch to request a product or service. This could be in-person, over the phone, or via email.

2. A Draft Quote is Supplied

Your staff at the branch follow the standard procedure to provide a quote for the request.

3. The Customer Negotiates

The customer asks for a higher discount rate. Branch management negotiates a different discount based on their discretionary powers.

4. A Final Quote is Supplied…

…and while it differs from the expected value slightly, it still remains within an acceptable range.

The Reality: What Really Happens

Now let’s see what happens when messy reality enters the picture.

1. The Customer Makes a Request

As above, the customer contacts a branch with a purchase request.

2. A Draft Quote is Supplied

Staff supply an initial draft quote following the standard procedure.

3. The Customer Negotiates

The customer asks for a higher discount rate. This time however, either one or both of the following occur:

- Without consulting branch management, a staff member makes a judgement call and gives away an excessively large discount

- Branch management is consulted, but decides to give away a greater discount than they are authorised to

4. The Final Quote is Supplied…

…and it significantly deviates from the pricing matrix dictated by head office.

Revenue leakage has now been introduced into the process—and the organisation’s HQ is none the wiser.

The Human Element

As you can see, there isn’t necessarily deliberate deception—or malice—occurring in the above scenario.

On the contrary, staff usually have the best intentions when offering a customer an unauthorised discount, often assuming that the final quote remains within profitable limits.

Unfortunately, staff all too frequently overlook various additional costs, such as the actual cost of goods sold (COGS), operational costs, delivery costs, tariff changes and more.

Contributing Factors

So we know why revenue leakage occurs. Now, let’s look at how.

Paper Systems and Editable Software Applications

In 2024, it goes without saying that paper invoices pose a significant threat to financial transparency across an organisation. If your business still uses paper invoices, transitioning to a digital system should be a top priority.

But software applications have their vulnerabilities too. Most quote/invoicing software lets staff export documents into Word document , creating the opportunity to manually edit invoices and quotes without restriction. Some applications even allow manual editing before exporting it, again enabling unauthorised changes without supervision.

And once revenue leakage has occurred, it’s difficult for an outside observer to identify. Manually reviewing all past invoices to ensure they align with the pricing matrix is time-consuming and labour-intensive, and because of this, management often audits only a small, random sample of past invoices, allowing many more incorrect invoices to go unnoticed, perpetuating revenue leakage.

Impact of Revenue Leakage

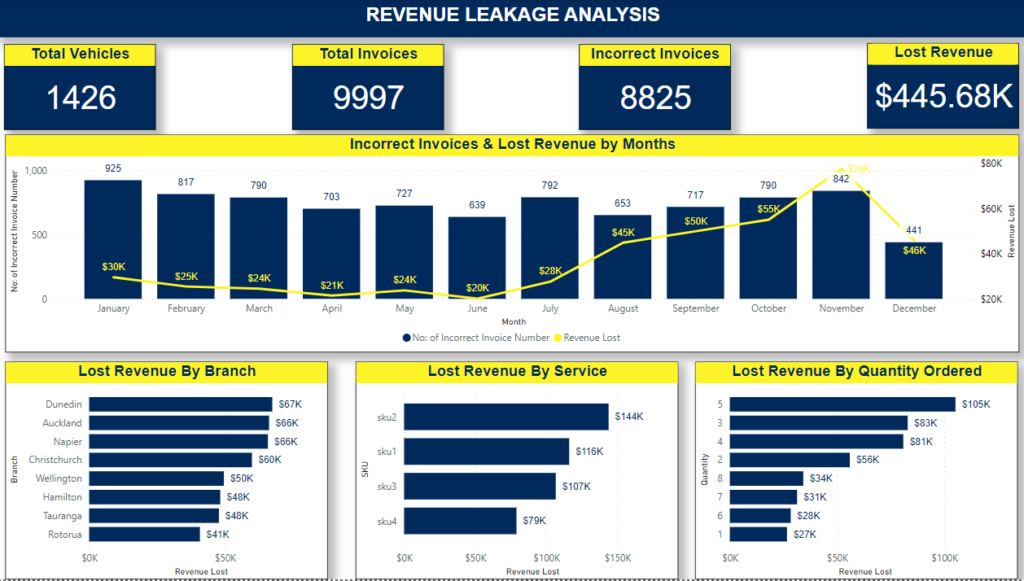

FOYI’s analysis of fleet operations reveals a concerning degree of revenue leakage in Kiwi organisations.

Based on our observations, we estimate that approximately three to five per cent of all invoices issued contain incorrect discounts.

While this percentage might seem small at first glance, it’s important to understand the full context and implications of this variation:

Higher Value Transactions

These incorrectly discounted invoices are not randomly distributed. They tend to be concentrated among higher-value transactions, amplifying their impact on overall revenue.

Cumulative Effect

Over time, even small discrepancies accumulate into significant amounts, especially in the high-volume operations typical of fleet management.

Ripple Effect

Incorrect discounting also sets unwelcome precedents with customers, leading to expectations of similar discounts in future transactions, further compounding the issue.

And remember, this leakage represents not just lost income, but also missed opportunities for reinvestment, fleet upgrades, or improved services. Addressing this issue goes beyond recovering lost revenue; it’s about optimising pricing strategy to ensure long-term profitability and competitiveness in the market.

How to Stop Revenue Leakage

Stopping revenue leakage requires a systematic, multi-faceted approach, combining data analysis, process improvement, and behavioural change.

Let’s explore the four key steps to effectively combat revenue leakage.

Step 1: Assess the Situation

The first step is to determine the extent and prevalence of revenue leakage across your branches. If revenue lost is within acceptable limits, there may be no need for further action.

Step 2: Identify Patterns

Analyse the data to identify whether the leakage is evenly spread or concentrated in specific branches, staff members, months, products, or customer groups. Pinpoint the areas contributing disproportionately to revenue leakage.

Step 3: Investigate and Identify Causes

Engage with the people involved in significant revenue leakage instances to understand the underlying causes.

Step 4: Address Behavioral Issues and Strengthen Controls

Address the behavioural reasons through leadership meetings and training sessions. For issues arising from non-adherence to pricing rules, work with your IT department to modify software applications to prevent revenue leakage.

Third-Party Analysis

While internal efforts are always required, leveraging specialised third-party data analysis will significantly enhance your ability to identify leakage and prevent future financial losses.

At FOYI, we understand the complexities of revenue management in diverse business environments and have developed tailored tools to support our clients in preventing revenue leakage. We can produce a comprehensive insight report (as shown below).

For more information about our revenue leakage report and how it can benefit your business, get in touch today.

Strategies for Fleet Owners

By understanding the root causes and implementing strategic measures to address revenue leakage, you can mitigate this problem effectively.

Key Takeaways:

- Ensure your pricing data and discounting processes are well-defined and communicated

- Enlist a third-party data analyst to provide insight into the scale and scope of revenue leakage in your organisation

- Monitor and control the editing capabilities of your invoicing software

- Train staff to consider all relevant costs when offering discounts

- Implement comprehensive and automated auditing processes

- Regularly review and refine your revenue leakage prevention strategies

Revenue leakage in fleet operations is a complex challenge, but it’s one that can be effectively managed with the right approach. By implementing the strategies outlined in this guide—from assessing the situation and identifying patterns to addressing behavioural issues and strengthening controls—you’re investing in the long-term financial health and competitiveness of your fleet operation.

Take action today. Talk to FOYI about aligning pricing performance across all levels of your organisation.

Contact Us for an introductory call to understand how we can help you.